GOP budget will add $5 trillion to deficit. Approaching a dangerous line.

Replies to: GOP budget will add $5 trillion to deficit. Approaching a dangerous line.

MAGA math: Tax cuts for billionaires, huge tariff sales taxes for everyone else

(no message)

Of course, both parties suck at this.

Just go back to the 2019 budget, offset the additional interest (which is growing out of control) across the board cuts.

Probably have to repeal some of the crap spending like the Inflation Reduction Act.

OK. Both parties have dug us a hole. How do massive tax cuts close the gap?

We need to raise taxes and trim spending -- ensure bang for the buck prudent expenditures. Cutting off funding for medical research and USAID is not prudent. Quite the opposite.

We don't have to raise taxes as it is not a revenue problem.

We shouldn't be lowering them either, what we should do is rip and replace the tax code and remove all deductions.

We need revenue to close the gap.

Your idea to simplify tax code by removing deductions = more revenue.

Now back to 2025. Tell us how the GOP proposed tax cuts will reduce the $36 trillion deficit?

See 2017 for guidance.

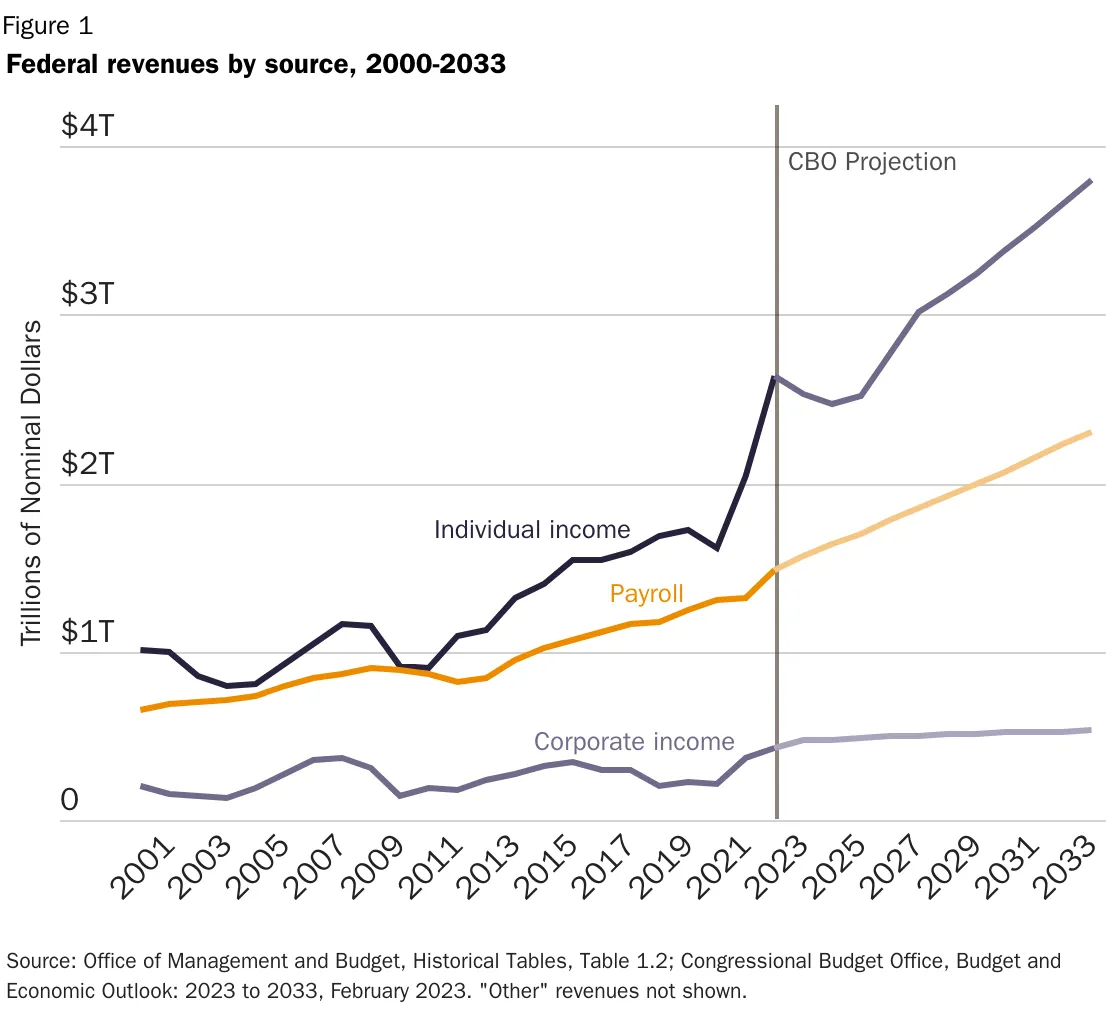

lowering taxes led to more revenue

(no message)

Link: https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/#federal-revenue-trends-over-time

2019 Budget $4.4T, 2024 Revenue $4.9T.

If you think you can squeeze more revenue out fine, but along with eliminating deductions, I would adjust the rates that most people don't pay. Two people who make $150K should pay the exact same amount. I don't care who has kids, a mortgage, is married, etc. Those are personal budgetary choices.

Also, we have to eliminate negative effective rates. If you want to say the rate is zero if you make $50K a year, fine. But tax returns should not be charity.

Now, if we really wanted to be rational. We would tie the federal budget to the previous year's revenue - 10% until the debt is payed off. Congress' job would then be to allocate the budget. I don't think this is a complicated problem to solve.

Given that the Defense Budget for 2019 was $734B it would take draconian cuts

to Discretionary Spending without an increase in taxes...assuming no cuts in the DOD. Do the right thing and learn from Clinton/Gore's approach...it works.

Cutting from the Discretionary isn't "draconian."

We need to spend less than we're bringing in, and it needs to extend for quite a few years to get this back under control.

Yeah, probably like 50 years. That's what happens when the budget more than doubles over 10 years.

(no message)

Projected Tax Revenues for this year are >$5T.

There is no reason we can't limit spend to $4T and keep a $1T annual surplus and get us on a path to financial health again.

In 1965, CEO/Avg Worker Compensation was 21/1...right now the ration is over 340/1...Corps and the

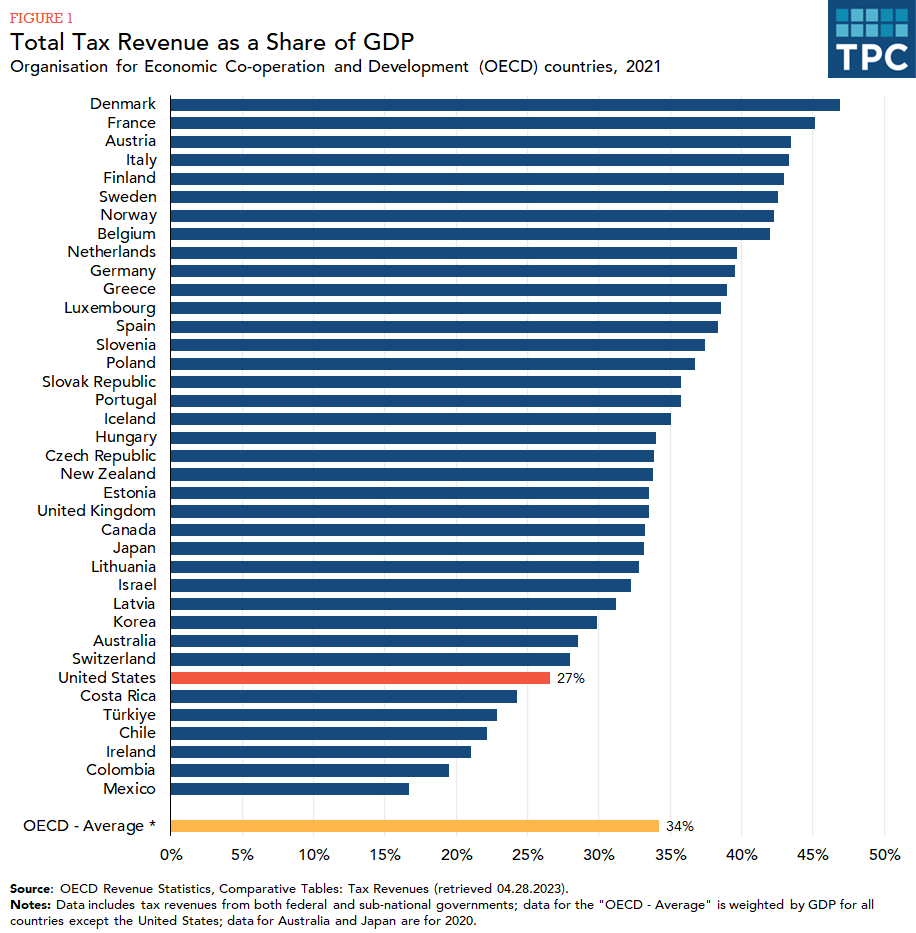

Wealthiest Americans can pay more of their 'Discretionary' Income...now let's compare the U.S. taxation level versus other countries...(see link)

Link: https://taxpolicycenter.org/briefing-book/how-do-us-taxes-compare-internationally

To be clear, I have ZERO problem with moving back to Reagan-era marginal tax rates at the top.

(no message)

Clinton's era delivered a budget surplus...why not support his tax increases on Corps and the

Wealthy?

Congress gets $4.4T to spend, they have to figure out how to do it. BTW, 2014 was $3T

(no message)

$3.1T is Mandatory + Interest...Revenue = $3.5T...now solve the problem.

(no message)

2024 revenue was $4.9T.

(no message)

You're moving the goal posts, Cheeks ;-)...pick any year you want...just stick with it and we'll

debate how to bring our deficit under control...deal?

Yeah, you're not getting this.

One last try, if we go back to the 2019 budget we would have a surplus of about a half Trillion.

How do you get a $0.5T surplus on $3.5T of income in 2019?

(no message)

Basic math.

(no message)

Show it.

(no message)

Already posted in this thread.

(no message)

I already debunked your math.

(no message)

I'm guessing that story problems were an issue for you in school.

You're using the wrong numbers, idiot.

If the US revenue in 2024 was $4.9T and the 2019 budget of $4.4T was implemented, how much would be saved in 2025 assuming revenues remained at 2024 levels?

Stick with any one year…then itemize each discretionary program being cut…when you’re

Finished we’ll talk some more.

It's not 2019 anymore, but we can go back to that budget, get it?

We can survive on a pre-CoVid budget is the point. It was only 5 years ago. And 5 years before that it was $3T.

2014 $3T

2019 $4.4T

2024 $6.8T

See the problem? (Hint: it's not revenue)

See the attached link...which programs...and how much from each...do you recommend be cut?...this is

Reality...not an abstraction.

Link: https://usafacts.org/articles/which-states-rely-the-most-on-federal-aid/

I get it, you don't believe in cutting any spending.

(no message)

You're not a very serious person, Cheeks...are you simply trying to hide and avoid the real world?

You've got more than enough going for you, why act the fool when there's no need to?

As for my views on Spending Cuts...just do a search for the multiple times I've referenced and applauded Clinton and Gore for the phenomenal work the did with Cuts, Taxes and a Surplus...don't need to post misinformation any more. Now that you know the truth, if you bring it up again, you'll be guilty of knowingly Lying...tsk, tsk...don't do that.

Google "debt spiral", because that's what we're headed for.

(no message)

Once the GOP accepts truly Progressive Taxation, we'll be able to resolve our Debt problems...

just like the Clinton administration and rational Republicans did.

btw, every developed country incurs a level of debt...insisting on no debt negates needed investments for future growth, or speedy recoveries from financial or natural disasters.

You are fixated on only one aspect of debt...open both your eyes.

When's the last time we had no debt, you idiot?

The answer appears to be 1835. I can't have a rational conversation with a person justifying debt at 120% GDP with "well, all countries have debt".

You didn't Google "debt spiral" so I am done with you.

Virtually NO country operates without 'sovereign debt'...the issue is how much of GDP that debt

represents...that's our current problem. It's not in a nation's 'interest' (pardon the pun) to seek zero debt. (Google Investopedia to understand why).

Once you appreciate the real issue we can continue this conversation....

btw, note the substantial rises in our national debt in the Chart Image, after 1) Reagan's Tax Cuts...2) Bush's Tax Cuts...3) Obama's Rescue from the "Great Recession"...and 4) Trump's Tax Cuts and Biden rescue from COVID-19 pandemic. Again..........until the GOP learns Economics and accepts Tax Increases on Corps and the Wealthiest Americans. our Debt Crisis is only going to get worse...i.e. the ball is in your group's court.

Link: https://www.investopedia.com/updates/usa-national-debt/:max_bytes(150000):strip_icc()/ABreifHistoryofU.SDebt2-91f01d4d9b1041f782672b1970896212.png)

The Dem Party performed exceptionally well at this...the GOP effort couldn't be worse...

...the evidence is irrefutable and has been posted here multiple times...odd that you are still in the dark.

Link: https://apnews.com/article/trump-musk-doge-clinton-reinventing-government-gore-a95795eb75cacc03734ef0065c1b0a6d

You live in a fantasy world where you think the Gore Commission would be possible now.

(no message)

It took both parties cooperating...only the GOP refuses to do that, so write an email to your Rep

and Senators insisting that they do the same now...or lose your vote.

You know it's the right way to go...don't be a quitter...raise your voice...and not just here on this message board...I do.

Right, the petulant children with their stupid signs at the address are ready to compromise.

(no message)

The only "Petulance" lies with those refusing to increase taxes on Corps and the Wealthy...they

won't budge...tell them to learn from their predecessors and do the right thing...IT WORKS!

I assume the repetitive 3 dots are tears.

(no message)

You can't "Get There From Here" w/o raising taxes on Corps and the Wealthy...admit it.

(no message)

Not a revenue problem.

(no message)

Look at the entire picture, Cheeks...not just one chart with no context...

now explain how you would use only spending cuts along with massive tax breaks for Corporations and the Wealthiest Americans to bring our Deficit down.

Link: https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/

Your mind virus is acting up again.

(no message)

Having trouble facing reality, I see...

...look at it this way...if your family income just barely covers food, mortgage, and other mandatory expenses...do you opt for a pay cut to solve your problem?

You're refusing to factor in the Mandatory Expenses along with Net Interest...there's no way only Discretionary Cuts can square the circle.

It's a problem that can only be solved with both Revenue increases from Corps and the Wealthiest, as

well as spending cuts...your own preferred example of 2019 proves that. Democrats have shown the way already with Clinton's economic plan that resulted in a Surplus...Wake Up to reality.

Always. And there was a Republican Congress.

(no message)

Indeed...filled with Reps who were willing to raise taxes on Corps and the Wealthy, along with Cuts

in Spending that didn't traumatize federal workers or cripple needed services. The Senate approved those actions by a vote of 99 to 1.

Aren’t you special? -

(no message)

Consent Management